Cloud computing gives you on-demand access to computing resources—ranging from storage and processing power to fully managed services—without the need to invest in or maintain your own physical hardware. You can cut massive costs, eliminate maintenance headaches, and scale your services quickly with on-demand resources. Many companies and organizations are making the switch to cloud services to cut overhead and get things up and running faster. It's an obvious decision—cloud computing is better than managing physical servers. But here's the catch—it doesn't come cheap. You have to invest heavily in underlying services.

Gartner's Forecast Analysis projects the global cloud market to grow from $595.7 billion in 2024 to $723.4 billion in 2025, with estimates reaching between $2 trillion and $2.4 trillion by 2030.

Here's the main issue: cloud adoption is happening fast, and it's creating a major problem—managing cloud spend. It’s ridiculously easy to blow your budget if you’re not keeping a close eye on it. Research from Flexera's 2024 State of the Cloud Report shows that roughly ~27% of cloud spending goes to waste—that's roughly a third of your cloud costs simply vanishing. This is mainly because of inefficiencies like overprovisioning and poor management. If cloud costs keep spiraling out of control, you might start questioning whether the cloud is worth it. That’s where FinOps comes in. Short for Financial Operations, FinOps is a discipline that integrates finance, operations, and engineering practices to optimize cloud spending. It provides a structured approach to tracking, managing, and reducing costs—so you’re not throwing money away.

In this article, we’ll break down what is FinOps—exploring its definition, benefits, core FinOps principles, lifecycle, common implementation challenges, a strategic roadmap for adoption, and its future trajectory. Let’s dive right into it.

FinOps 101: What Is FinOps?

FinOps (Financial Operations) started as a response to the unpredictable costs that come with the pay‐as‐you-go cloud model. Early cloud adopters, like Adobe and Intuit, began experimenting with managing these costs. Back in the early 2010s, as companies moved to the public cloud (AWS, Azure, GCP), teams realized that managing variable cloud spend meant rethinking how costs were tracked and allocated. Over time, larger organizations such as GE (General Electric), Nike, and later Atlassian as well as others like Qantas and Tabcorp refined these practices to cope with rapidly changing cloud spending. This shift led to the creation of a community and a set of best practices that define today’s FinOps practice.

So, What Is FinOps?

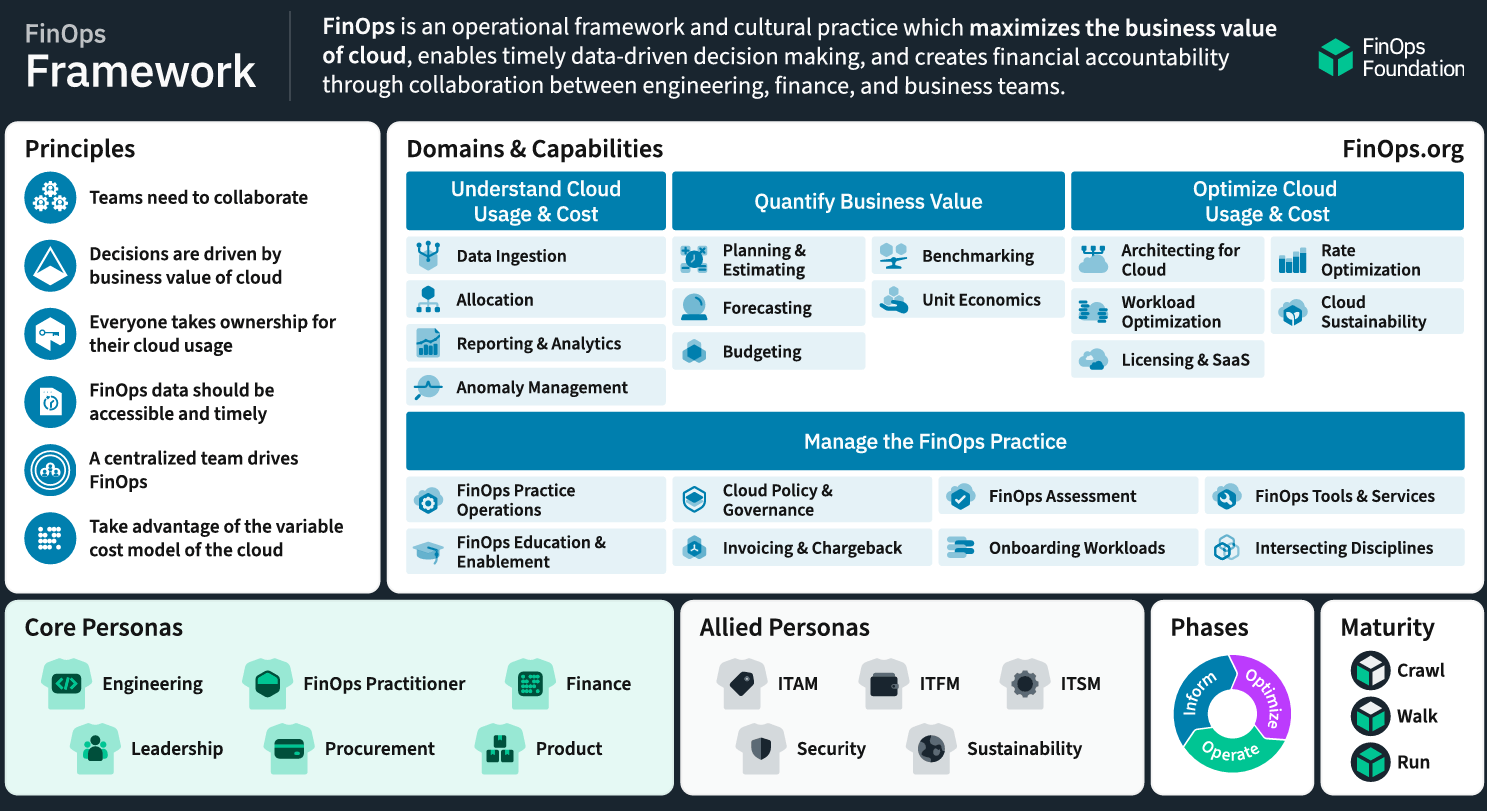

The term "FinOps" aka "Financial Operations" itself is a blend of "Finance" and "DevOps". According to the definition from the FinOps Foundation, FinOps is an operational framework and cultural practice which maximizes the business value of cloud, enables timely data-driven decision making, and creates financial accountability through collaboration between engineering, finance, and business teams.

It didn't go by "FinOps" back then. Instead, the practice had a more straightforward name: "cloud cost optimization". Later, major cloud providers like AWS and others started using the term "cloud financial management", which eventually became known as "FinOps".

As it turned out, professionals from different industries soon came to a similar conclusion: a standardized approach to cloud financial management was necessary. This led to the establishment of the FinOps Foundation—to create a space where people could collaborate, share knowledge, and work out industry best practices.

The FinOps Foundation developed a set of best practices for managing the cloud. They defined the core principles, practices, and methodologies of the FinOps Framework, along with some helpful resources, case studies, training, and tools to help individuals and organizations get the most out of their cloud spending.

In short, what is FinOps? FinOps (aka Financial Operations) is a cultural mindset that brings together different parts of an organization—such as executives, finance, and engineers—to work together to get more value out of the cloud.

What Are the Benefits of Finops?

Here are some key benefits of FinOps (Financial Operations):

1) Cut Cloud Costs — FinOps helps companies cut down on cloud computing expenses by finding and fixing wasteful spending.

2) Better Decision-Making — FinOps gives you a clear picture of how you're using the cloud and what it's costing you, so you can make quick, informed decisions that align with your goals.

3) Stronger Financial Performance — FinOps brings people from IT, finance, and business together, creating a culture where everyone works together to manage cloud spending.

4) Get a Clear View of Costs — FinOps provides detailed insights into cloud spending and usage, helping you track and understand your costs better.

5) Collab More Effectively — FinOps framework connects IT, finance, and business teams, making it easier to work together and share responsibility for cloud costs.

6) More Accountability — FinOps promotes a culture where everyone is accountable for their cloud usage, leading to better financial management.

7) Scale with Ease — FinOps practices are flexible and work for companies of all sizes, allowing you to quickly adjust your cloud financial processes as your needs change.

8) Optimize Your Cloud — FinOps helps you get the most out of your cloud provider services and maximize the value of your cloud investments.

9) Better Budgeting: FinOps makes it easier to accurately budget for and forecast cloud costs.

10) Enhanced Financial Security — Implementing Financial Operations can lead to better financial accountability and security within your organization.

The Path to FinOps: FinOps Framework

We already touched on this, but the FinOps Framework gives you building blocks to manage the FinOps culture in your team or org. It's made up of five key categories:

🔮 What Are the Principles of FinOps? (FinOps Principles)

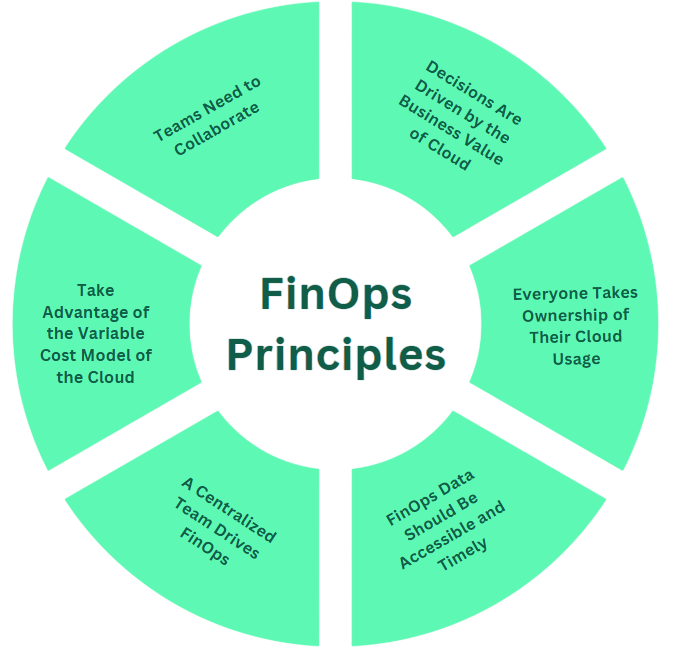

FinOps aka Financial Operations, is not just about cutting cloud costs; it's a cultural shift and a set of best practices designed to maximize the business value of your cloud investments. It's about enabling organizations to get the most out of the cloud while maintaining financial control and accountability. FinOps Foundation has laid out 6 key principles:

Let’s take a closer look at how each principle plays out in action.

1) Teams Need to Collaborate

FinOps is an inherently cross‐functional discipline. FinOps works best when finance, engineering, and business units share responsibility. You share cost data and coordinate spending decisions. This collaborative teamwork stops isolated departments from making decisions that hurt overall budgets. When all hands are on deck, you reduce waste and align spending with your company’s goals.

2) Decisions Are Driven by the Business Value of Cloud

Every cost-related decision should tie back to the value the cloud brings to your business. You look at spending in terms of business impact. This means comparing resource costs against the benefits they deliver. When you base decisions on measurable outcomes, you improve your investment returns and drive better performance.

3) Everyone Takes Ownership of Their Cloud Usage

Decentralizing accountability is at the heart of FinOps. FinOps assigns cost responsibility to individual teams. You track usage at a granular level so that every department can see the financial impact of its actions. With this approach, each team holds itself accountable for spending, leading to smarter resource allocation and a stronger commitment to cost control.

4) FinOps Data Should Be Accessible and Timely

Cost and usage data must be processed and shared as soon as available, providing real-time visibility to drive better utilization. Fast feedback loops enable teams to make adjustments, improving efficiency, with consistent visibility across all organizational levels. This involves creating, monitoring, and improving real-time financial forecasting and planning, using trending and variance analysis, and benchmarking against internal and industry peers.

5) A Centralized Team Drives FinOps

While accountability for cloud spending is decentralized, a centralized FinOps team acts as the governing body. They're in charge of setting best practices, negotiating prices with vendors, and maintaining consistency across the board. The team also maintains financial models, standardizes how costs are allocated and provides training/support to everyone involved. This way, everyone's on the same page, and processes are streamlined, which helps cut out unnecessary expenses.

6) Take Advantage of the Variable Cost Model of the Cloud

The cloud charges based on your usage (via pay-as-you-go model), which gives you flexibility. You adjust spending as your needs change. FinOps takes this variable cost model and turns it into an advantage. You track metrics in real time and use predictive models to plan your spending. This active management helps you optimize costs and match resources to actual demand.

Each principle is built on the idea that managing cloud spending is a team effort. By using them, you can take a more hands-on approach to managing costs and make sure they line up with what you and your business are trying to achieve.

Check out this article to learn more in-depth about the FinOps Principles.

🔮 Who are the Key FinOps Stakeholders? (FinOps Personas)

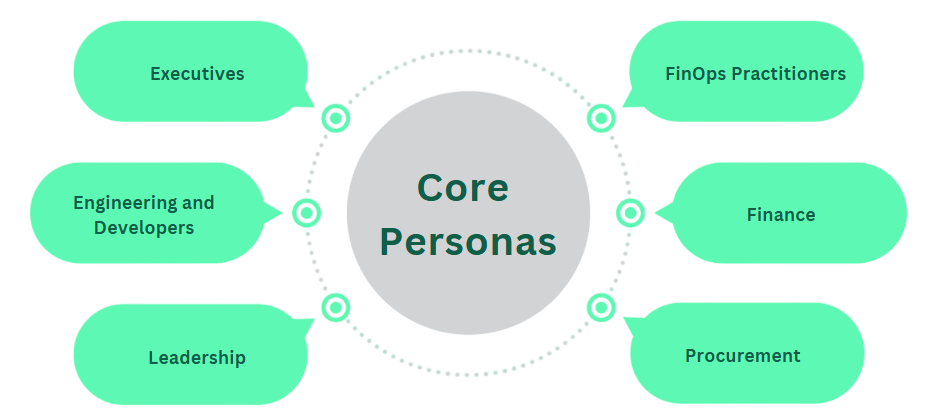

Now that we’ve broken down FinOps and its significance, the question is: Who is impacted by it, and who should ensure its culture stays strong? Just as our six core principles point out, it’s the responsibility of us all. There are 6 core and 5 applied cloud FinOps personas as defined by the FinOps foundation:

Core FinOps Personas:

The following six core personas form the backbone of a FinOps practice, as defined by the FinOps Foundation:

1) FinOps Practitioners

FinOps Practitioners are the professionals who run your day-to-day FinOps processes. You rely on them to collect data, monitor spending, and adjust cloud usage in near real-time. They work with dashboards, cost allocation tools (like CloudHealth, Cloudability, or native cloud provider dashboards), and reporting systems to keep you informed.

2) Executives (or Leadership)

Executives—such as CIOs, CTOs, or CFOs—provide strategic leadership and funding for FinOps initiatives. They review key performance indicators (KPIs), like cost-per-transaction or return on investment (ROI), to guide cloud investment decisions. Their main role is to back the operational teams with the resources needed to drive financial efficiency in the cloud.

3) Engineering and Developers

Engineering persona includes teams that design, deploy, and maintain cloud infrastructure and applications. They build and maintain the infrastructure that supports cost optimization. They adjust resource configurations and adopt automation tools that keep cloud spending in check.

4) Business Teams (or Product Team)

Business/Product teams align cloud spending with revenue and growth targets. They analyze cost data alongside performance metrics to decide which services to scale. Their input helps balance financial discipline with business opportunities.

5) Procurement

Procurement handles vendor contracts and pricing negotiations. They work to secure the best terms and optimize spending on cloud services. This role involves analyzing offers and managing relationships with multiple cloud providers.

6) Finance

Finance teams are in charge of budgeting, forecasting, and financial reporting for cloud spending. They implement mechanisms like chargeback (billing departments for usage) or showback (reporting usage without billing) to allocate costs accurately. Using historical data, they might forecast next quarter’s cloud spend, assuring compliance with financial standards and generating reports to support operational decisions.

Allied FinOps Personas:

The five allied personas support the core team by integrating FinOps into broader organizational functions:

1) ITSM / ITIL (IT Service Management / IT Infrastructure Library)

These professionals integrate cloud cost management into broader IT service management practices. They help you standardize processes and maintain consistency across your IT operations.

Key responsibilities:

- Service Design

- Service Operation & Improvement

- Service Level Monitoring & Management

- Change Management

- Cost Analysis and Optimization

- Documentation and Reporting

- Stakeholder Collaboration

2) ITAM (IT Asset Management)

ITAM focuses on tracking and managing cloud assets. They provide detailed inventories and usage patterns that feed into your cost management system, linking physical or virtual resources to spending data.

Key responsibilities:

- Asset Discovery and Inventory

- Asset Auditing and Compliance

- License Management

- Cost Analysis and Optimization

- Documentation and Reporting

- Stakeholder Collaboration

3) Sustainability

Sustainability experts add an environmental perspective to your FinOps efforts. They track energy use and carbon emissions, allowing you to manage both costs and environmental impact simultaneously.

Key responsibilities:

- Optimization for Sustainable Initiatives

- Waste Reduction

- Policy and Compliance

- Efficiency and Optimization Analysis

- Documentation and Reporting

- Stakeholder Collaboration

4) ITFM (IT Financial Management)

ITFM professionals manage the financial aspects of your IT operations. They bring insights into cost allocation, budgeting, and financial forecasting, linking your FinOps data with broader financial strategies.

Key responsibilities:

- Budgeting

- Cost Accounting & Optimization

- Financial Analysis

- Investment Prioritization

- Financial Reporting

- Continuous Process Improvements

- Documentation and Reporting

- Stakeholder Collaboration

5) Security

Security teams oversee compliance and risk management for your cloud resources. They monitor configurations and spending to detect anomalies that might indicate security vulnerabilities or unauthorized usage.

Key responsibilities:

- Monitoring and Anomaly Response

- Anomaly Investigation and Analysis

- Policy and Compliance

- Identity and Access Management

- Documentation and Reporting

- Stakeholder Collaboration

Each FinOps persona contributes specific skills and perspectives. Together, these roles help you align cloud spending management with various business functions, giving you a clear structure for tackling cost control.

Check out this article to learn more in-depth about the FinOps Personas.

🔮 FinOps Domains & FinOps Capabilities

The FinOps Framework categorizes cloud financial management into four primary domains. Each FinOps domain groups a set of related FinOps capabilities that help an organization manage and optimize cloud spending while tracking the business impact of its cloud investments. The following sections provide a precise technical overview of each FinOps domain and its capabilities—as defined by the FinOps Foundation.

| FinOps Domain | FinOps Capabilities |

| 1) Understand Cloud Usage & Cost |

|

| 2) Quantify Business Value |

|

| 3) Optimize Cloud Usage & Cost |

|

| 4) Manage the FinOps Practice |

|